DOF, Taipei City Government, participated in the Pan Pacific Congress of Real Estate Appraisers, Valuers and Counselors, sharing experiences in public property valuation and housing tax base assessment.

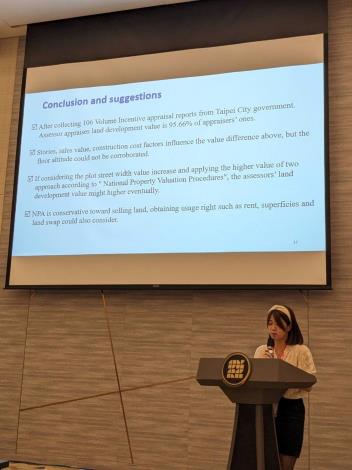

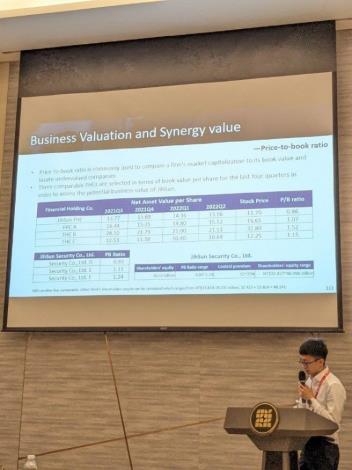

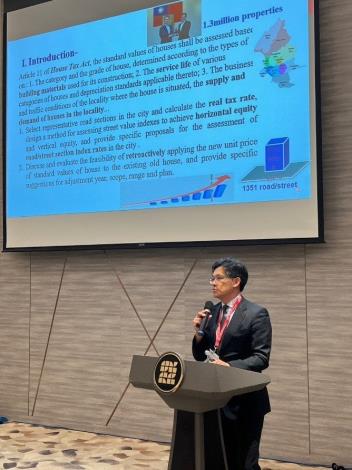

The Department of Finance (DOF), Taipei City Government (TCG) was invited to the 31st Pan Pacific Congress of Real Estate Appraisers, Valuers, and Counselors (PPC). PPC is a biennial event in the field of real estate appraisal, and our country is the host this year. It was organized by the Chinese Institute of Land Appraisal (CILA) in Tamsui District, New Taipei City, starting on September 5, 2023, and lasting for 4 days. The chairman of the CILA, Peng Chien-wen, as the conference chairman, explained that this is Taiwan's second time hosting the event since 2004. The theme of this international conference was "The Impacts of COVID-19 and Global Political Economy on Real Estate." It brought together a total of 12 member countries from the Pacific coast, including Japan, South Korea, and the United States, with nearly 500 participants from domestic and foreign government agencies and private-sector professionals. Participants include the Department of Land Administration, Ministry of the Interior (MOI), and DOF, as well as the Department of Land Administration from many counties and cities such as Taipei City, New Taipei City, and Taoyuan City. The Commissioner of DOF, You Shih-ming, led more than 10 colleagues from DOF and the Taipei City Revenue Service to participate in the conference. During the conference, they presented articles and shared the experiences of Taipei City in assessing public city property values and the tax base of house tax with representatives from various countries. The conference invited the Political Deputy Minister of MOI, Hua Ching-chun, to share insights on the housing market and residential rental market. New Taipei City Deputy Mayor Liu Ho-jan announced the efforts of New Taipei City government in pursuing net-zero emissions, while Commissioner You provided additional information on the process of promoting the Taipei Municipal Autonomy Regulations for Municipal Treasury during the conference. DOF presented 3 articles at this conference. The first article, titled "Is National Land Development Value Higher than Appraisers' Appraised Value?" was presented by Subdivision Chief Liu Ting-ju. In this article, Subdivision Chief Liu analyzed the differences between governmental appraisers' valuation and appraisers' valuation based on her previous experience in executing the sale of non-public properties at the Northern Region Branch, National Property Administration, MOF. The second article: "Business Valuation and Synergy Value of Financial Institutions: A Case Study of the Taipei Fubon Merger" presented by Specialist Dai Guo-zheng, took the merger of Taipei Fubon Bank as a case study to illustrate how financial institutions assess the value of business and synergy benefits. The third article, "How does Taipei City House tax reassessment in line with IAAO?" by Commissioner You based on the effective house tax rates from 2020 to 2022, as well as the COD (Coefficient of Dispersion) and the PRD (Price Related Differential), explained how Taipei City's house standard price references the International Association of Assessing Officers (IAAO) metrics for assessing consistency and fairness. This evaluation resulted in rate adjustments for specific segments completed in the first half of this year by the Real Estate Assessment Committee. On the final day of the conference, participants also visited the POPOP Taipei and the Taipei Music Center in Nangang, both of which serve as significant milestones symbolizing industrial transformation in Taipei City. Commissioner You stated that by participating in this international large-scale conference and exchanging ideas with experts and scholars from Taiwan and countries along the Pacific coast, not only does it allow the international community to better understand Taipei City's efforts in property value assessment and tax evaluation, but it also provides an opportunity for the colleagues of DOF to broaden their horizons and expand their international perspectives. This lays a solid foundation for Taipei City's journey towards becoming a first-class international metropolis.

![Taiwan.gov.tw [ open a new window]](/images/egov.png)